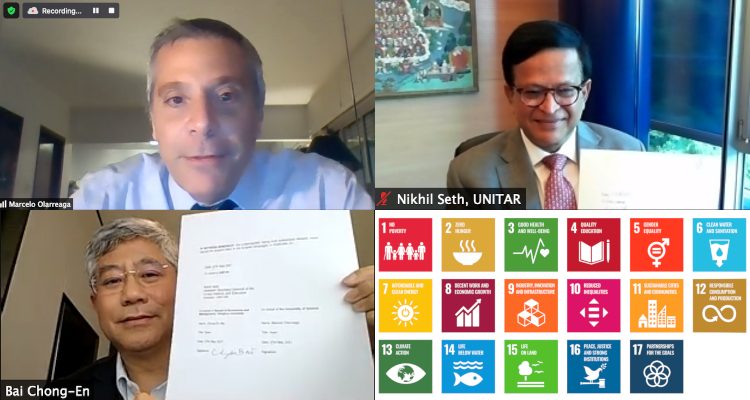

This Tsinghua University course (undergraduate-level) is a part of the Global Hybrid Classroom (GHC) Certificate program.

This program provides a comprehensive and systematic introduction to financial knowledge for aspirants to the financial industry. Students are expected to understand the basic framework of modern financial analysis and be able to apply what they have learned to project valuation, risk analysis, corporate investment decision-making, and investment management. The program will be taught in English, and students are required to be proficient in English.

“Foundation of Finance” certificate is compromised of 4 courses:

Global Hybrid Courses (GHC) is currently open to current students from overseas partner universities of Tsinghua University, and it’s free. If your university (instructor or students) would like to join the program and experience what it is like to teach and learn in a truly global classroom, please contact the Assistant Secretary-General of the Global MOOC Alliance at [email protected] or [email protected].

How to attend our GHC courses?

- Tsinghua University will send the list of GHC courses to overseas partner universities every semester. These universities will notify students to enroll and priority will be given to students eager to take part

- Students from overseas partner universities have to complete the courses required by the GHC Certificate within a specified time. After completing each course, they will receive a GHC transcript issued by Tsinghua University.

- Students from overseas partner universities attending Tsinghua’s postgraduate courses, whose own universities do not allow for credit transfer, can enjoy credit exemption if they study for postgraduate degrees at Tsinghua University in the future.

How to apply for the certificate upon completion of the required courses?

- Please send your name, university, and GHC transcripts to us at [email protected]